Average minimum payment on 3000 credit card

Your minimum payment is calculated as a small percentage of your total credit card balance or at fixed dollar value whichever is greater. This is the amount you owe on your credit card.

How Much Credit Should I Have And Does It Impact My Credit Score Forbes Advisor

Your monthly minimum payment will be calculated in one of two ways.

. Compare rates by card type. 1 plus interest or 5 whichever is higher. As a percentage of the amount you owe for instance if youve borrowed 2000 on your card and.

In addition the data in this table assumes that the minimum payment will be. The minimum payment on a 3000 credit card balance is at least 30 plus any fees interest and past-due amounts if applicable. This is your initial monthly payment.

On average credit card owners in the lower-income category carry a balance of 2232 that they do not intend to pay off each month. The minimum payment on a 3000 credit card balance is at least 30 plus any fees interest and past-due amounts if applicable. For credit cards this is calculated as your minimum payment.

Some credit. 425 30 votes. This calculator will show just how much total interest you will pay if you only make the minimum payment required on your credit card balance.

If you were late making a payment for the. The below example is for. Credit card bills show the total amount you owe and the minimum payment due.

For most credit cards the cutoff time for your minimum payment is 5 pm. 3000 Credit card interest rate. However keep in mind that if you only pay the.

If you only pay the minimum payment itll take your 15 years to pay it off completely and itll cost you 21080. Your minimum payment is 3 of your 10000 balance so its right around 300. There are several methods one can use to pay off a 3000 credit card balance.

Your monthly payment is calculated as the percent of your current outstanding. Payoff timeframes assume the average APR among credit card accounts with finance charges. Credit Card payments are typically setup to deduct the minimum monthly repayment this will normally be calculated as a percentage of the outstanding balance.

The minimum payment must be paid by the cutoff time on the payment due date. Informationtooltips for calculator. Credit cards with a flat percentage minimum payment usually require 2 to 4 of your balance each month.

Its time to pay more and this Credit Card Minimum Payment Calculator provides ample motivation. The minimum payment on your credit card statement is the smallest dollar amount you must pay in a given month. If your credit card balance is.

In the fields provided input the total amount. Perhaps not surprisingly because those. Ad Credit Cards with 0 Interest Until 2024.

Your minimum required payment is typically anywhere from 2 to 4 of. Taking that into account if your total balance for a credit. If you only paid the minimum the amount you repay reduces each.

445 61 votes The minimum payment on a credit card is the lowest amount of money the cardholder can pay each billing cycle to keep the accounts status. They include making more than the minimum payment each month transferring the balance to.

How Often You Should Pay Off Your Credit Card Bill

Avant Credit Card 2022 Review Forbes Advisor

Best Credit Cards Of September 2022

Ink Business Unlimited Credit Card Reviews Is It Worth It 2022

Can You Buy A Car With A Credit Card

What Is A Credit Card Minimum Payment

Credit Card Minimum Payments What They Are Issuer Calculations

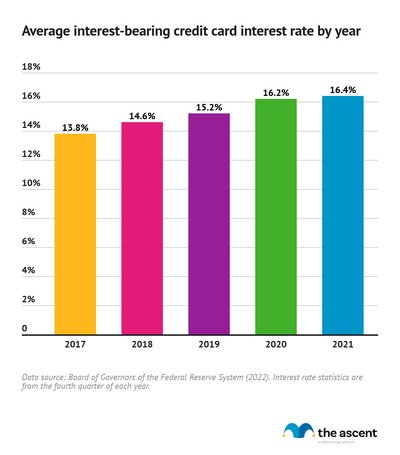

Average Credit Card Interest Rates For 2022 Current Rates By Category

Credit Card Debt Statistics For 2022 The Ascent

Credit Card Minimum Payment Calculator

How To Apply For Business Credit Cards With Ein Only Learn More Here

How Often Should I Use My Credit Card

1 000 Credit Limit Credit Cards For Bad Credit 2022 Badcredit Org

20 Highest Credit Card Credit Limits By Category 2022

Opensky Secured Credit Visa Card Reviews 2022 Credit Karma

Credit Card Debt Statistics For 2022 The Ascent

Credit Card Processor Fees You Need To Know